Swiss defend $17BN AT1 bond wipeout in Credit Suisse deal as furious creditors including David Tepper vow to sue Switzerland

03/26/2023 / By News Editors

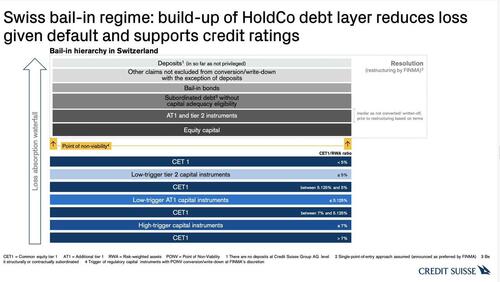

Amid the justifiably shocked outcry from Credit Suisse junior debtors, who saw their entire AT1 debt tranche wiped out before the equity was fully impaired, violating every conventional liquidation waterfall, on Thursday Swiss financial regulator Finma has defended its decision to wipe out a huge swath of risky subordinated bonds as part of the Credit Suisse rescue deal even as an army of bondholders is preparing to sue the Swiss government.

(Article by Tyler Durden republished from ZeroHedge.com)

Sunday’s shocking bail-in, which rendered $17BN of investments worthless, has become one of the most controversial elements of the shotgun marriage between Credit Suisse and its larger rival, UBS, brokered by Swiss authorities. Just hours after the deal was announced, other large market regulators began to distance themselves from the decision, fearful that it would endanger banks’ ability to raise capital in the future.

Meanwhile, enraged bondholders have pledged to sue the Swiss government and Finma over the matter the FT reported.

In its first statement on the deal since the weekend, Finma said on Thursday that all the contractual and legal obligations had been met for it to act unilaterally given the urgency of the situation.

“On Sunday, a solution was found to protect clients, the financial centre and the markets,” said Finma’s chief executive Urban Angehrn. “In this context, it is important that Credit Suisse’s banking business continues to function smoothly and without interruption.”

Speaking to the press on Thursday, Swiss National Bank chair Thomas Jordan argued that the purchase by UBS had been the only option for Credit Suisse, saying that a takeover of the bank by the government and stabilization of it in a process known as resolution would have risked a systemic crisis.

“Resolution in theory is possible under normal circumstances, but we were in an extremely fragile environment with enormous nervousness in financial markets in general,” said Jordan. “Resolution in those circumstances would have triggered a bigger financial crisis, not just in Switzerland but globally.”

“[It] would not have worked to stabilize the situation but, on the contrary, created enormous uncertainty . . . It was clear that we should avoid it if there was any other possibility.”

None of that explains why the decision was taken to preserves CHF3.25BN in value for CS shareholders – who would nominally be subordinated to any bondholders in the capital structure – even as junior creditors were wiped out.

That said, the additional tier 1 (AT1) bonds in question were warned as they contained explicit contractual language that they would be “completely written down in a ‘viability event’ in particular if extraordinary government support is granted”, Finma said. This allowed the regulator to prioritise equity holders ahead of AT1 holders. Furthermore, when AT1s were created as a hybrid debt instrument after the financial crash of 2008, their whole purpose was to give banks greater capital flexibility in the event of crises, and for the bonds to be bailed in in case of need.

Meanwhile, the government’s intervention to bail out the combined UBS-CS entity – because if Credit Suisse had gone under, UBS was certainly next – is undisputable: as part of the acquisition deal by UBS, the combined bank will receive CHF9BN of government guarantees and a CHF100bn liquidity lifeline from the SNB. An additional emergency government ordinance issued by Bern on Sunday had further confirmed the power to take decisions over elements of a bank’s capital structure in Swiss law, Finma said.

“[The] instruments in Switzerland are designed in such a way that they are written down or converted into [equity] before the equity capital of the bank concerned is completely used up or written down,” it said, pointing out that the bonds were designed for the use of sophisticated institutional investors because of their risky hybrid nature.

None of that however has helped ease the anger of bondholders who over one weekend saw their entire investment wiped out. Quinn Emanuel Urquhart & Sullivan and Pallas Partners are among the law firms representing bondholders that have pledged to fight the Swiss decision. Quinn hosted a call on Wednesday joined by more than 750 participants.

Partner Richard East told the Financial Times the deal was “a resolution dressed up as a merger” and pointed to statements by the European Central Bank and the Bank of England, which distanced themselves from the Swiss approach.

“You know something has gone wrong when other regulators come and politely point out that in a resolution [they] would have respected ordinary priorities,” he said.

“If this is left to stand, how can you trust any debt security issued in Switzerland, or for that matter wider Europe, if governments can just change laws after the fact,” David Tepper, the billionaire founder of Appaloosa Management, told the Financial Times. “Contracts are made to be honored.”

Tepper is among the most successful investors in troubled financial companies, famously making billions of dollars on a 2009 wager that US banks would not be nationalised during the last financial crisis. Appaloosa had bought a range of Credit Suisse’s senior and junior debt as the bank descended into chaos.

Mark Dowding, chief investment officer at RBC BlueBay, which held Credit Suisse AT1 bonds, said Switzerland was “looking more like a banana republic”. His Financial Capital Bond fund is down 12.2 per cent this month.

No matter how the lawsuits turn out, however, one thing is certain: Swiss banking as an industry that thrived and prospered for centuries, is effectively over and nobody will voluntarily either deposit or invest in Swiss banks after this catastrophically bundled government intervention. For the sake of what’s left of the Swiss economy, we can only hope that the cheese and chocolate industries are not in need of bailouts.

Read more at: ZeroHedge.com

Submit a correction >>

Tagged Under:

AT1, banking, banks, bonds, collapse, corruption, Credit Suisse, currency, debt, finance, fraud, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2020 Debtbomb.news

All content posted on this site is protected under Free Speech. Debtbomb.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Debtbomb.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.