INFLATION WOES: Millennials crumble, turn to social media to air frustration over soaring cost of living

08/21/2023 / By Belle Carter

As the soaring cost of living continues to plague and hunt the lives of Americans and Canadians from all walks of life as well as people from all around the world, they resort to social media to vent out and air their frustrations.

Millennials and Gen Z are the main target market of these platforms. People from these age groups are the most likely to post and browse for topics about how they are breaking down or increasingly becoming unable to afford basic necessities, such as food and housing. X, formerly Twitter, account user @WallStreetSilv compiled videos from the short-form video hosting service TikTok, wherein these adults talked about their struggles. The first video included a woman inquiring: “I have a question: how are we affording life right now?”

The cost of living crisis is astronomical everywhere. It feels like we’re just working to barely survive ???

Compilation of videos with people talking about the struggle going on.

This is a must watch video. ?

— Wall Street Silver (@WallStreetSilv) August 15, 2023

Next in the montage was s a slideshow of photos of people in seemingly “existential crisis.” The clips were captioned with their worries and fears on how to survive and that no matter how they work, the cost of living is still out of their price ranges. In the short video compilation, young people are also talking about how they are suppressing their “cravings” and avoiding doing the things that they want as these have become a luxury already.

“I am living paycheck to paycheck every week because I am trying to pay every bill that the world is throwing at me right now,” another woman stated. One crying woman said, “I can’t function anymore. Financially I just don’t understand anymore. I don’t understand how I make $34 an hour and I can’t function. I can’t pay my bills. I can’t even literally keep gas in my car to get to work three days a week because I can’t afford it.” Another woman said, “I want to know how people in Canada are even living. I just feel trapped…I can’t afford the rent these days…I’m just feeling so much despair.”

There were videos comparing the number of groceries items that can be bought with $100 in 2020 and 2023. Another lady explained the problem with food costs: “I just got back from doing groceries, and I have $70 worth of groceries on my table right now and I genuinely don’t even know what I purchased that made it to $70. I am working like three jobs right now,” she added. “The cost of living is outrageous in Canada.” Some even consider leaving because nothing is affordable in Ontario, the video included.

The sad part, according to another one, was that wages are not going up fast and they are left without a choice but to use their credit cards. This only gets them deeper into a sea of debt.

A separate post from Wall Street Silver featured a guy asking himself: “Was university a complete waste?” on his TikTok post. It had a caption: “Middle-class millennials in 2023,” where the user said, “If I seriously had any idea life was going to be this hard and expensive and my degree did not mean sh*t, I would have dropped out of school when I was like in third grade and bought my first four-bedroom house for $5000 when I was like seven.”

Millennials in 2023: ???

Was university a complete waste?

— Wall Street Silver (@WallStreetSilv) August 16, 2023

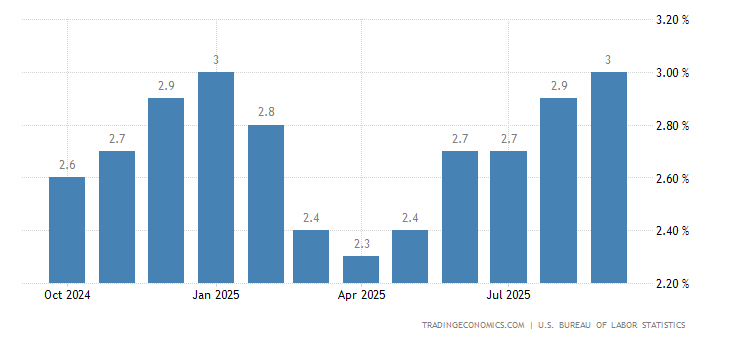

Inflation rate starts to get hot again

As per InfoWars, inflation coupled with elevated interest rates, is crushing the younger generation with no indication that it will come down anytime soon. And still, President Joe Biden’s Federal Reserve is standing firm that they have cooled down inflation with its interest rate hikes. How will they explain it going up again as it did before it even hit the two percent target? (Related: Powell insists 2% target inflation is still distant so Fed raises interest rates again to the highest level in 22 years.)

According to the Bureau of Labor Statistics, the annual inflation rate accelerated again to 3.2 percent in July 2023 from its lowest three percent in June, which stopped the 12 consecutive months of declines.

A year ago, inflation had started to fall from its peak of 9.1 percent. Last month, energy costs fell 12.5 percent, less than a 16.7 percent drop in June, with prices declining at a smaller pace for fuel oil (-26.5 percent vs -36.6 percent), gasoline (-19.9 percent vs -26.5 percent) and utility gas service (-13.7 percent vs -18.6 percent). Inflation reportedly slowed for food (4.9 percent vs 5.7 percent), shelter (7.7 percent vs 7.8 percent), and new vehicles (3.5 percent vs 4.1 percent).

However, prices of apparel (3.2 percent vs 3.1 percent), and transportation services (nine percent vs 8.2 percent) increased more. On the other hand, electricity prices also rose three percent, below 5.4 percent in June.

Bookmark Collapse.news for stories about the collapsing worldwide economy.

Sources for this article include:

Submit a correction >>

Tagged Under:

Bidenflation, big government, bubble, collapse, cost of living, debt bomb, debt collapse, economic collapse, economic riot, expensive, fed, finance riot, food inflation, Gen Z, inflation, interest rate, market crash, millennials, money supply, pensions, rate hike, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2020 Debtbomb.news

All content posted on this site is protected under Free Speech. Debtbomb.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Debtbomb.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.