60% of Great Britain’s manufacturing sector risks closure due to soaring energy prices

09/14/2022 / By Ethan Huff

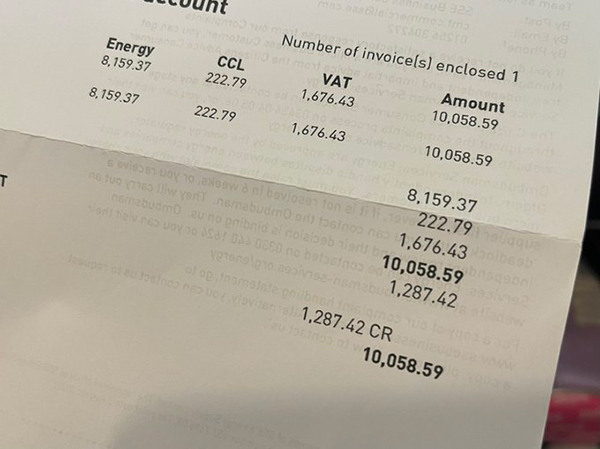

The results of a new survey on the current state of the British economy are dire, suggesting that as many as six in 10 manufacturing businesses throughout the country are at risk of closing due to skyrocketing energy bills.

MakeUK, a manufacturing lobby organization in the United Kingdom, announced over the weekend that 42 percent of British manufacturing businesses have already seen their electricity bills double over the past year. About 32 percent have also seen their gas bills double.

Already, some 13 percent of British manufacturers have had to pare down their hours of operation to compensate for energy inflation. Twelve percent, we are told, have had to lay off workers as a result of ever-increasing energy costs.

If things continue on the current hyperinflationary trajectory – and there is no reason to believe otherwise – then at least 50 percent of British manufacturing businesses will have to close up shop entirely in the coming months.

“Out of control energy bills are now business threatening for 60% of manufacturers,” tweeted Make UK Campaigns about how the figure is likely even higher. “We’re calling on Government to look at introducing an Industry Price Cap to freeze energy bills at an agreed rate.”

Goldman Sachs says UK inflation to reach 22 percent next year

MakeUK has proposed a 100-day plan for the new incoming prime minister, Liz Truss, that lays out a roadmap for navigating the crisis. It includes:

- A call for an emergency budget

- A demand to commission the Migration Advisory Committee (MAC) to review the Shortage Occupation List (SOL), which outlines key job roles in high demand throughout the UK that could be recruited from overseas more easily

- An overhaul of the Apprenticeship Levy “to ensure British people are among the most productive and highly skilled workers in the world”

As wholesale energy prices continue to soar, banking giant Goldman Sachs has issued a prediction that inflation in the UK could reach 22 percent next year. This is what MakeUK is trying to plan ahead for by pushing energy price caps.

Keep in mind that a major driving factor in the energy crisis is the UK and Europe’s aggressive push for “green” energy. Going green, it turns out, means going lean on everything, including the national economy.

An energy bill protest is also on the way come October when tens of thousands of Brits are expected to just stop paying.

Goldman Sachs says that the energy sector could see another more than 80 percent price increase before the next review in January, which, combined with other sectors of the economy, “impl[ies] headline inflation peaking at 22.4 percent.”

“Inflation in Britain reached double digits for the first time since the 1980s in July, and if Goldman Sachs estimates were to be realized, the cost of living in the UK would come close to hitting the country’s post-war record of 24.5 percent inflation set in August 1975,” reported Remix about the situation.

“In the U.S., we should be refusing to pay taxes until the government cleans up their act,” added a commenter at Natural News about the situation here, where gas prices remain artificially spiked while industry stakeholders and corrupt government officials (i.e., 10 percent for the “big guy”) rake in record profits.

“It’s far beyond time for a tax revolt.”

Another person agreed, emphasizing that the criminals in charge do not deserve another penny from the taxpayers they have already raped and pillaged with their wicked policies.

“There should be riots everywhere with people everywhere making their voices heard loudly and clearly,” suggested another.

The latest news about the European energy crisis can be found at EnergySupply.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

bubble, chaos, collapse, debt collapse, electricity, energy prices, energy supply, fuel supply, inflation, MakeUK, manufacturing, market crash, money supply, panic, power, power grid, risk, United Kingdom

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2020 Debtbomb.news

All content posted on this site is protected under Free Speech. Debtbomb.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Debtbomb.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.