Americans spent more on taxes than on food, healthcare, clothing and education COMBINED in 2021

09/14/2022 / By Arsenio Toledo

Americans spent more on taxes in 2021 than on food, healthcare, education and clothing combined. Overall, taxes accounted for about 25 percent of average consumer spending. This was according to the consumer spending data from the Department of Labor‘s Bureau of Labor Statistics (BLS).

The BLS report on 2021 consumer expenditures was released on Thursday, Sept. 8. It found that taxes are creating an undue burden on the majority of Americans who are already experiencing financial hardships due to President Joe Biden and his administration’s inability to deal with inflation. (Related: Biden is still spending TRILLIONS of taxpayer dollars that were set aside for COVID-19 stimulus.)

“Average annual expenditures for all consumer units in 2021 were $66,928, a 9.1 percent increase from 2020,” the report stated.

The BLS measures spending per “consumer unit,” which the agency described as either members of the same household who are related by blood, marriage, adoption or other legal arrangements; people living alone, sharing a household with others or living permanently in a private home, lodging house, hotel or motel but who are financially independent; or two or more people living together in the same household who pool their income together to make joint spending decisions.

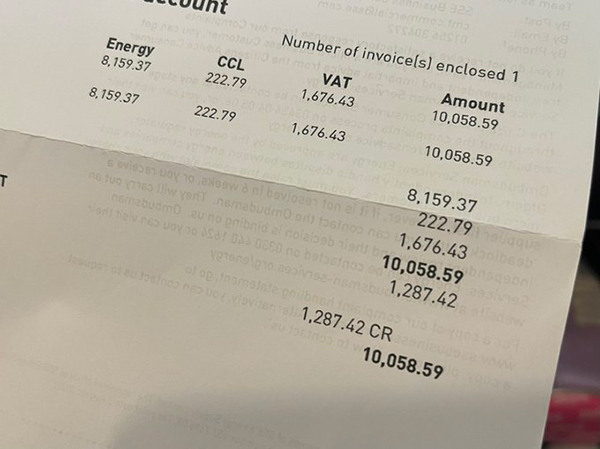

On average, each consumer unit paid $16,729.73 in taxes in 2021. This included $8,561.46 in federal income tax, $2,564.14 in state and local income taxes, $5,565.45 in Social Security deductions, $2,475.18 in property taxes and $105.21 in other taxes. Some of these costs were offset by an average stimulus payment of $2,541.71.

By contrast, the mean total for spending per consumer unit on food, healthcare, clothing and education was $16,721.42. This includes $8,289.28 on food, $5,451.61 on healthcare, $1,754.39 on clothing and $1,226.14 on education.

Consumer spending up in many categories compared to 2020

Spending on entertainment was up nearly 23 percent over 2020 and up 15.5 percent from 2019. Spending on apparel and services rose by 22.3 percent compared to 2020. Average annual income taxes also increased by 3.7 percent in 2021 compared to the previous year.

Alcohol spending per consumer unit was $553.77 in 2021, up 15.9 percent over 2020 levels. The BLS report showed that most of this additional spending was driven by people purchasing and drinking alcoholic beverages outside of their home – suggesting that more people took advantage of relaxed lockdown regulations to hang out and drink with friends in social settings like bars and restaurants. In fact, the BLS report showed that “alcohol at home” spending was down 7.9 percent compared to 2020.

Housing still accounted for the highest share of annual expenditures at 33.8 percent, or $22,623.55. This was followed by transportation at 16.4 percent ($10,961.18), food at 12.4 percent and personal insurance and pensions spending at 11.8 percent of household expenditures.

Meanwhile, personal incomes only rose by between three to four percent for the top three income groups and just 0.6 percent for the second lowest income group. The average incomes of the lowest income group even decreased by 0.4 percent.

The bottom line of the BLS report is that the average American consumer unit was unable to keep up with the surge in the cost of living, especially with inflation at a 40-year high. The situation is made worse for Americans due to exceptionally high taxation.

Learn more about how Americans are dealing with the inflation surge at Inflation.news.

Watch this clip from Fox Business as a market expert talks about how American inflation is still “insanely high.”

This video is from the News Clips channel on Brighteon.com.

More related stories:

Food shortage simulation predicts 400% SURGE in food prices by 2030.

INFLATION BOMB: American household spending over $700 MORE per month due to inflation.

Inflation Reduction Act will not fight inflation but only force Americans to pay more in taxes.

Sources include:

Submit a correction >>

Tagged Under:

big government, bubble, collapse, consumer spending, debt bomb, debt collapse, economic collapse, economics, economy, finance, financial crash, inflation, insanity, money supply, personal finances, risk, taxation, taxes, taxpayers

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2020 Debtbomb.news

All content posted on this site is protected under Free Speech. Debtbomb.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Debtbomb.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.