Bank of America warns: Inflation genie is out of the bottle

09/30/2022 / By Belle Carter

President Joe Biden, his administration and the Fed have been constantly assuring America that the record-breaking inflation is under control. The Bank of America (BofA) doesn’t think so.

“The inflation genie is out of the bottle,” the bank wrote in a research note last week, emphasizing that it could be a long time before it “goes back inside the bottle” and everything comes back to normal.

BofA’s team of analysts headed by Athanasios Vamvakidis found that in cases of inflation above five percent in advanced economies from the 1980s to 2000s, it took 10 years on average to bring inflation back down to two percent. “The consensus still expects G10 inflation to drop to two percent by 2024, but we are concerned it could take longer,” the analysts wrote.

They further said that central banks around the world are actually “not in full control” of inflation, pointing out that policy tightening has its limits.

“Inflation in advanced economies today is much higher than five percent and has not even peaked yet in most cases,” they noted. “We should not necessarily expect that inflation will be back to the two percent target in only a couple of years.”

The analysts said it could take more policy tightening and they did not give an exact timeline for when they believed the country’s inflation could be truly manageable. The team, however, presented two possible scenarios: a positive “soft landing” for the economy if interest rates go down, or a negative “hard landing” if they continue to increase and the Fed is forced to continue to hike interest rates.

While their baseline is leaning toward the positive scenario, the analysts believe that the risks for the negative scenario could not be ignored. They await the rest of the year’s inflation data to help them predict which scenario would unfold.

As of August, inflation was down slightly by 0.2 percent from July’s reading of 8.5 percent, pushing the Fed to implement the third consecutive interest rate hike of 75 basis points last week.

“We do not necessarily expect that it will take a decade to bring inflation down to the two percent target in advanced economies,” the analysts stated in the note. “However, the historic evidence on inflation calls for caution.”

Inflation exhausts the average American family’s budget

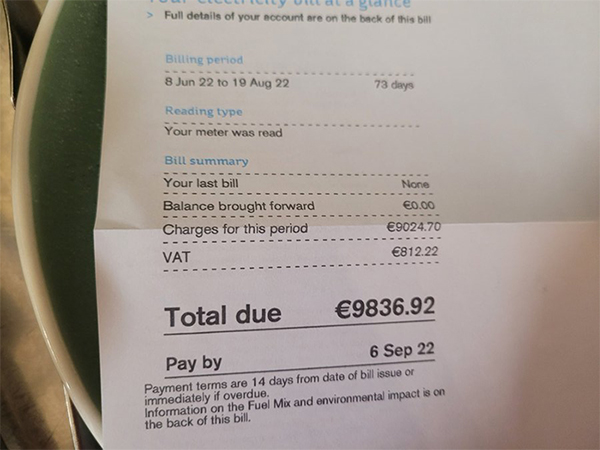

In the meantime, American families would have to expend from their own pockets an extra $11,600 this year, according to new estimates by personal finance firm NerdWallet. (Related: Inflation under Biden, Democrats costing Americans more than $11,000 a year per household.)

The estimates were based on inflation and annual spending data from the Bureau of Labor Statistics. The company analysts said they studied how spending would compare this year to 2020 when the Wuhan coronavirus (COVID-19) pandemic began.

If Americans would want to follow the same standard of living they did in 2020, they would need to spend the said extra amount. According to the analysts, 2020 was the “last full year when inflation was relatively stable” at 1.23 percent.

“In all of 2020, American households spent $61,300, on average. This number includes everything we spend our money on housing, food, entertainment, clothing, transportation and everything else,” they wrote.

The analysts added that in 2022, it stands to reach $72,900 if consumers want to maintain the same standard of living.

Visit Inflation.news for more news related to the highest inflation recorded in the U.S. in four decades.

Watch this video that explains how the government – not corporations – is causing inflation.

This video is from the InfoWars channel on Brighteon.com.

More related stories:

Inflation forces Americans to rely on credit cards for daily expenses.

Glenn Beck: COVID-19 pandemic is over, inflation has hardly risen – in Biden’s mind.

Fox News reporter interrupts Biden’s Inflation Reduction Act speech to give live REALITY CHECK.

Sources include:

Submit a correction >>

Tagged Under:

Bank of America, Bidenflation, bubble, chaos, collapse, crisis, debt collapse, economic collapse, economy, Federal Reserve, finance, inflation, Joe Biden, market crash, money supply, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2020 Debtbomb.news

All content posted on this site is protected under Free Speech. Debtbomb.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Debtbomb.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.