Bakery owners in Germany protest sky-high energy bills amid worsening energy crisis in Europe

09/22/2022 / By Mary Villareal

A German bakery saw its gas bill rise to €330,000 ($323,900) after a new energy company terminated its contract with the business that guaranteed fixed pricing until the end of 2023.

Eckehard Vatter, the owner of the Vatter bakery chain, lamented that he was given only 14 days to pay the bill. Until a year ago, the business only paid €5,856 ($5747.66) every month for their large baking furnaces and heating.

Now, the bakery’s energy bill shot up to a staggering €75,000 ($73,612.50) – which amounted to €330,000 ($323,900) for four and a half months of energy use. The new energy supplier did not even give a reason for its 1,200 percent increase in energy prices.

Making things worse for Vatter, the bakery is considered a “craft business” under commercial law, which means he can’t receive any government support even though he paid €19.9 million ($19.53 million) in taxes in recent years. In contrast, industrial bakeries that produce cheap bread are eligible to receive aid from Berlin.

Established in 1955, the Vatter bakery chain has 35 stores and 430 employees in the state of Lower Saxony. While the business has weathered every crisis since its establishment, things have never been as bad as they are now.

Vatter is not alone in his predicament. Peter Hemmerle, owner of the Heinz Hemmerle bakery in Muelheim, said he expects his company’s annual electricity bill to quadruple to €1.2 million ($1.18 million). The bakery uses electricity to run its kneading machines and cooling rooms.

Daniel Schneider, head of Germany’s bakery association, said: “In the baking trade, many companies are up to their necks in water, they no longer know how to bear the costs.”

As a result, hundreds of bakery owners took to the streets on Sept. 14. They protested in downtown Hanover, Lower Saxony’s capital, to draw attention to their worsening situation.

Berlin promises to address skyrocketing energy prices

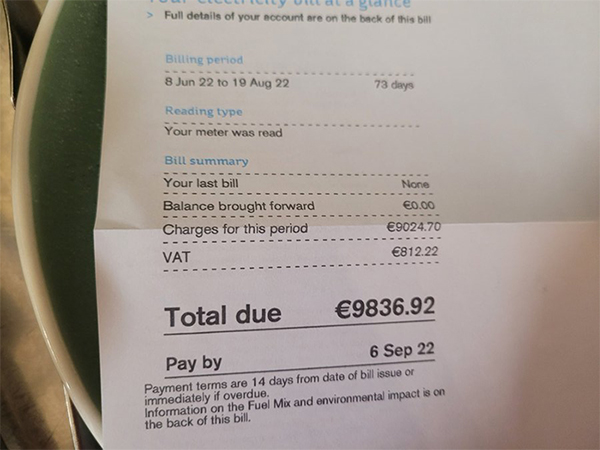

People across the continent had been posting viral photos of absurdly high energy bills in the past few weeks. This prompted Berlin to announce a €65 billion ($63.80 billion) relief package to cushion citizens and businesses from the skyrocketing energy costs. This proposal, agreed upon by Germany’s tripartite ruling coalition, brought total energy subsidies since the beginning of the Russia-Ukraine war to almost €100 billion ($98.15 billion).

Among the measures are one-off payments to millions of vulnerable pensioners and plan to make use of energy firms’ windfall profits. This means that there will be a creeping nationalization of the energy sector.

A few days after the relief package was announced, Economic Minister Robert Habeck promised to help small and medium businesses in a speech in Berlin, saying that they will open a “wide rescue umbrella” that will allow small and medium enterprises to take shelter under. Habeck – who also serves as Germany’s vice chancellor and climate minister – blamed poor leadership, the state of the country’s infrastructure and its overdependence on Russian energy.

According to Habeck, liquefied natural gas (LNG) could be the key to solving Germany’s energy crisis. But with problems in infrastructure and lack of fuel on the open market, significant problems are still to be expected. (Related: Natural gas shortage worsening in Europe and will trigger food crisis in coming months: Report.)

Former U.S. President Donald Trump warned about this four years ago.

“Germany will become totally dependent on Russian energy if it does not immediately change course,” he said in a speech at the 2018 United Nations General Assembly. “Reliance on a single foreign supplier can leave a nation vulnerable to extortion and intimidation.”

Visit PowerGrid.news for more updates about the ongoing energy crisis in Europe.

Watch the video below for more information about Europe’s out-of-control energy crisis.

This video is from the Puretrauma357 channel on Brighteon.com.

More related stories:

Sources include:

Submit a correction >>

Tagged Under:

bakeries, big government, bubble, chaos, collapse, debt collapse, economic collapse, electricity, energy bills, energy crisis, energy report, Europe, fuel supply, Heinz Hemmerle, inflation, market crash, natural gas

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2020 Debtbomb.news

All content posted on this site is protected under Free Speech. Debtbomb.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Debtbomb.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.